Just like having a financial plan for your personal finances can help you reach your personal goals, having a strategic business plan for your business can help you grow it so you can sell it when you are ready to... Read More

There are three key questions to ask a company that wants to buy your business: Will they maintain your culture, your people, and your management team? Are they willing to be cutting-edge in their technology and invest for the future?... Read More

Is your business positioned properly so you can sell it at retirement? Tune in as Crystal discusses the remaining four questions you should be asking yourself when preparing to sell your business! Watch us on our YouTube channel Find out more... Read More

Is your business positioned properly so you can sell it at retirement? Tune in as Crystal discusses the first of five questions you should be asking yourself when preparing to sell your business Watch us on our YouTube channel Find out... Read More

How do you make predictions for 2024 and be confident that they are accurate? You base your predictions upon human nature and emotions! The stock market is full of companies and the numbers associated with them… emotions of the consumers... Read More

The stock market is like the supermarket. You need to understand what you are going into to buy and stay on track with your list! Don’t get sidetracked by what others are buying or the sales flyer promoting what they... Read More

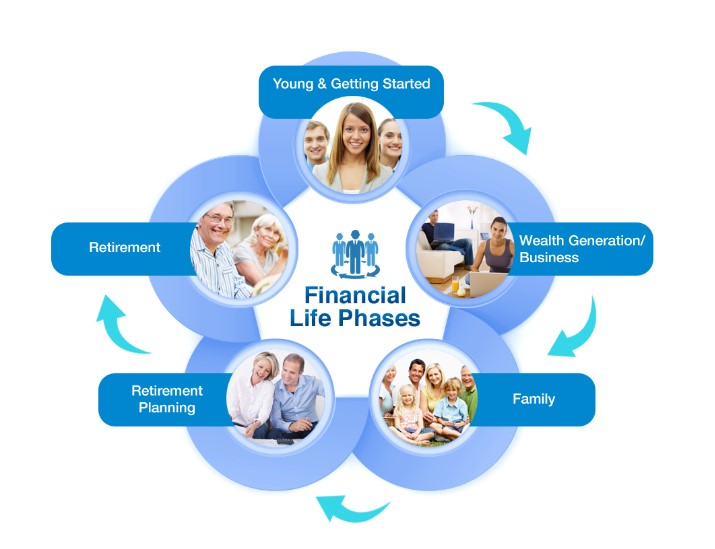

Market Cycles, Business Cycles, Retirement Cycles… We can learn so much from the patterns of life. This applies to finances too! On today’s program we will finish our two-part series by reviewing the 5 remaining predictions for 2023 and discuss... Read More

It’s fun to dream about the future and the possibilities it can bring, but it’s also important to take time to review the past. What can we learn? How could it impact us going forward? What would we do differently?... Read More

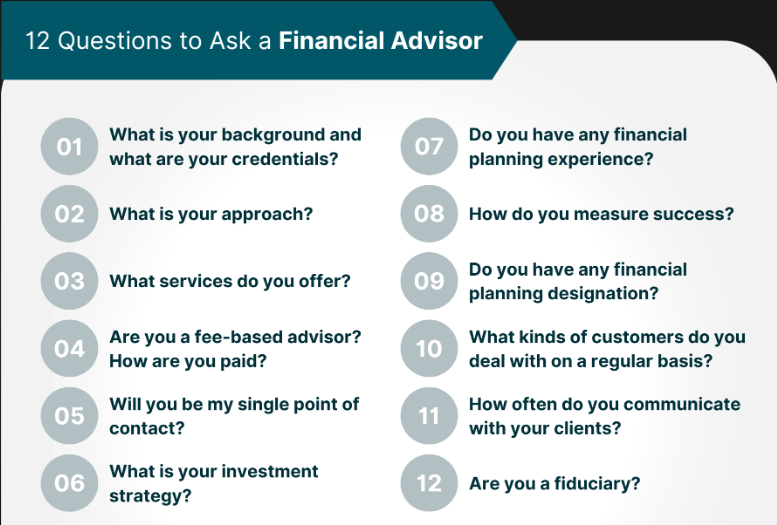

In the final session of “Are you being Sold/12 Questions to Ask When Looking for an Advisor”, Crystal discusses the importance of an advisor needing a plan for documentation, cybersecurity, and being willing to invest in a quality team. Watch... Read More

Join Crystal Langdon, CFP®, as she continues Part 3 of “Are you being Sold? 10 Questions to ask when looking for an advisor you can trust!” Today’s topics include understanding the sales process of an advisor and determining if it... Read More